- May 4, 2024

-

-

Loading

Loading

Certain low-income seniors may be receiving a property tax break in the future, depending on an upcoming decision by the Flagler County Board of County Commissioners.

The commission must decide whether to implement a constitutional amendment that voters approved last year, which exempts certain seniors from the full assessed value of their homesteaded property if they meet certain qualifications. Although the amendment passed on the state level, local governments have the authority to decide whether to implement it.

To qualify for the exemption, a property owner must be at least 65 years old with an adjusted gross income of $27,590 or less annually. The owner must have lived on the property for at least 25 years, and its just value must be less than $250,000.

In Flagler County, about 3,100 seniors meet the income and age thresholds for the tax break. However, of those seniors, just 3%, or about 91 households, meet the 25-year residency standard.

Supporters of the amendment say it would provide much-needed assistance to low-income seniors. Critics say it’s too exclusive, making it unfair: Seniors meeting all the income requirements who had only lived on their properties for 20 years, for example, would not be eligible for the tax break.

The County Commission discussed the potential break during a workshop meeting on Monday. The matter will come before the commission for vote at a future regular meeting.

If the commission approved the exemption, it would only apply to taxes levied by the County Commission. Other local municipalities would also have to decide whether to adopt the exemption for their own taxes.No cities in Flagler County have yet implemented the tax break, which was approved by 63% of Flagler County voters last year.

But Jay Gardner, Flagler County property appraiser, said he didn’t think voters fully understood what the tax exemption entails.

“I think everyone wants to help people who are low-income, but what we’re going to do is help 91 people who are low income, and 3,000 people will have to pay that much higher taxes,” Gardner said. “we’re dealing with a number small enough that it’s not going to hurt anybody … But the bottom line is, you’re helping just the lucky people here.”

If implemented, county staff estimates that the tax break would have a general fund impact of $29,219, and a general revenue impact of $31,261.

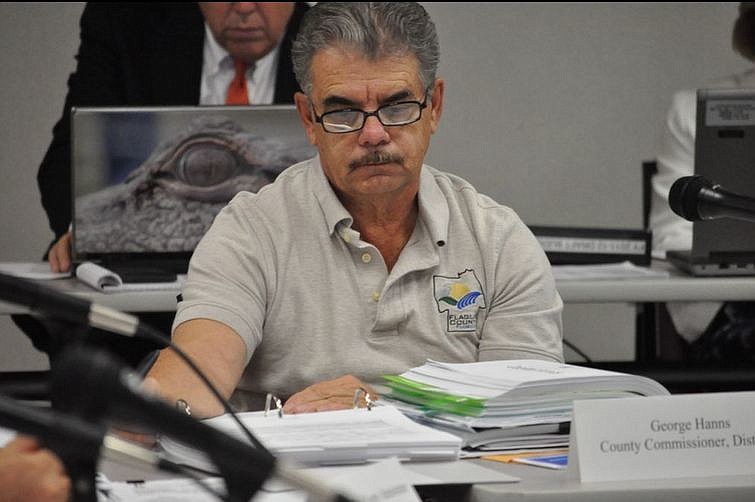

“I think that what little relief would be available would be a big help to these people, who are on a fixed income,” Commissioner George Hanns said.

The commission’s vote on the tax break has not yet been scheduled.